- Home

- Conventional

- Lending Products

Lending Products

Our lending products’ portfolio is comprehensive and diverse, tailored to meet your financial requirements and to support your goals of economic prosperity.

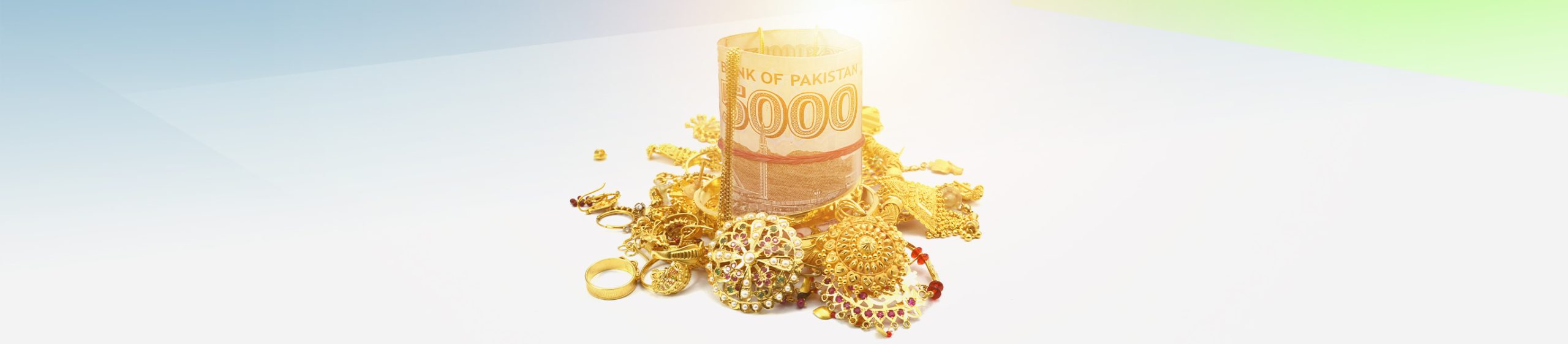

Gold Loans

Sunehra Sarmaya Loan

Make good use of your valuables!

U Bank offers the Sunehra Sarmaya Loan facility which allows customers to maximize the potential of their valuable assets, such as gold bullion, jewelry, etc. This loan facility can easily be utilized to gain access to funds aimed to meet business, agricultural, and livestock trade needs at affordable terms.

Karsaz Gold Loan

For all your emergency fund needs!

U Bank offers an immediate loan facility for micro-entrepreneurs, agriculture and livestock businesses, and business ventures. The Karsaz Gold Loan can be availed to meet their working capital needs and for the purchase of assets to enhance their business and income, against collateral of gold bullion, gold ornaments, gold biscuits, jewelry, etc. This loan facility can be utilized for the establishment of a new enterprise and caters to the needs of salaried individuals, retired persons, and housewives for their emergency needs. The Karsaz Gold Loan can also be availed for house renovation.

Business Loans

Khud Mukhtar Loan

Fuel your income and business growth with financial support!

U Bank enables salaried individuals to augment their earnings through the Khud Mukhtar Loan facility. With this loan product, customers including salaried individuals can receive funds for the establishment of a new business or expand their existing business, opening up avenues for additional sources of income for them.

The Khud Mukhtar Loan provides working individuals a chance to build a progressive future for themselves by giving them opportunities to create or uplift their side business.

Bank Guarantee

Now grow your business with confidence!

U Bank offers the Bank Guarantee facility with which its customers, including farmers and small and medium-sized entrepreneurs, can foster their businesses and enhance their potential. This facility offers a 100% Cash-Back Bank Guarantee for buyers and sellers, to help them secure new contracts, expand their business, and establish trust with their suppliers.

A bank guarantee is a written instrument guaranteeing that the bank, on behalf of its customer, will cover the payments of the respective customer in case they default. This enables customers to purchase supplies and equipment on credit for the smooth running of their businesses, while adding credibility to their everyday transactions.

This facility is available for a specified amount of financing and time period.

Sarmaya e Taleem

Building better futures together!

U Bank brings affordable private school financing for school owners. ‘Sarmaya-e-Taleem’ is an education loan that allows private school owners to easily construct, expand, and renovate their owned school buildings. The loan can also be used to purchase furniture, equipment, and computers for the use of students, establish or expand computer labs with the purchase of hardware and software equipment, and improve educational standards with the training and development of teachers.

Barhta Karobar Loan

Expand and flourish your business!

U Bank offers a larger sized loan facility for small and medium enterprises to help them meet their business financial needs. Small retailers, medium-sized firms, as well as school owners can utilize the Barhta Karobar Loan facility to help expand and flourish their existing businesses with the purchase of raw material and other business equipment

General Purpose Loans

Laptop & Mobile Financing

Business at your convenience!

U Bank brings for its customers the perfect opportunity to purchase their choice of brand’s mobile phone or laptop on easy installments. Salaried individuals and business owners can easily remain connected in this digital world, by availing U Bank Laptop and Mobile Financing facility, with which customers can buy a laptop or mobile phone without having to pay the full purchase amount upfront, and easily fulfill their business or personal digital requirements.

U Bank Running Finance

Better access to financial freedom!

U Bank is offering Running Finance loan facility exclusively designed for salaried individuals and small & medium businesses. With this facility, customers can meet their everyday working capital requirements and fund their short term business needs.

Running finance is a revolving finance, where the customer is free to withdraw and repay amounts within the extent of the agreed upon limit, as many times the customer wishes to. This is the perfect financing solution for businesses with daily cash flows and quick turnovers, where they can avail financing for the amount and duration of their choice, at any point in time, without additional documentation requirements.

The Running Finance facility comes with complimentary health insurance for customers, of up to PKR 50,000 for the 1st year.

Tankhwa Loan

Your perfect solution for unexpected money requirements!

U Bank offers the Tankhwa Loan facility for salaried individuals with which they can have access to funds required to fulfill their emergency monetary needs. With this loan facility, salaried persons can easily receive a loan of up to PKR 350,000 on equal monthly installments.

Pension Loan

Worry and hassle-free access to funds!

U Bank offers the Pension Loan facility of up to PKR 350,000 for pensioners (Government & Semi-Government). With equal monthly installments, the Pension Loan can easily fund the personal and business financial needs of pensioners.

Agri Loans

Agricultural Loans – Zarai Qarza & Agri Passbook Loan

For your perfect harvests!

U Bank offers Agricultural Loans in the form of the Zarai Qarza and the Agri Passbook Loan for small and medium-scale farmers. These loans enable them to easily and timely purchase seeds, fertilizers, pesticides, modern agricultural machinery & tools, and additional agricultural land.

Tractor & Equipment Loan

Achieving better yields made easier!

U Bank offers the Tractor & Equipment Loan facility for agricultural customers to facilitate the purchase of tractors and other necessary machinery meant for farming. Farmers can use this loan to purchase agriculture machinery including tractors, trailers, threshers, Laser levelers, sprayers, seed drills, combine harvesters, levelers, fodder cutters, etc.

Livestock Loan

Convenience like never before!

U Bank offers the Livestock Loan, which brings ease and convenience for both men and women involved in the livestock business and enables them to fulfill all their business needs. The Livestock Loan can be availed for the purchase and care of small and large animals, breeding, shed construction, medicine and vaccination, purchasing milk chillers, and acquiring other livestock business-related equipment and materials.

Vehicle Loans

Commercial Vehicle Financing

Set the wheels of your business in motion!

U Bank Commercial Vehicle Financing is a loan facility that enables its customers to own a vehicle to fulfill their business needs, such as the transportation of enterprise goods, agriculture commodities, livestock, milk supply, and passenger mobility.

Available for all local brands in Pakistan, U Bank Commercial Vehicle Financing comes with complete vehicle insurance and a tracker facility.

Motorbike Loan

Wheel your way to success!

U Bank offers the Motorbike Loan facility through which small-scale businessmen and salaried individuals can own their motorbike easily and in a very short time. The Motorbike Loan can be availed on easy monthly installments at a minimal markup rate.

Home Loans

Mera Ghar, Mera Ashiana

Government Subsidized Housing Scheme

In an effort to promote affordable housing finance, the Government of Pakistan has introduced the “Mera Ghar, Mera Ashiana” Markup Subsidy and Risk Sharing Scheme.

U Bank Home Loan

Now build the home of your dreams!

U Bank offers Home Loan facility to salaried individuals, business owners, and pensioners, for the purchase of a complete residential property, apartment, flat, or house. U Bank Home Loan can also be availed for construction on a newly-purchased or previously owned plot, its structural improvement, or for the purpose of house renovation.

Climate Financing

Solar Financing

Fulfill your energy needs at affordable rates!

U Bank offers Solar Financing facility for farmers, micro-entrepreneurs, and households to easily fulfill their power and energy needs. This financing facility enables U Bank customers to get a solar system on installments and is the perfect opportunity for them to bring down their electricity bills, while contributing positively towards the environment.

Women-Centric Products

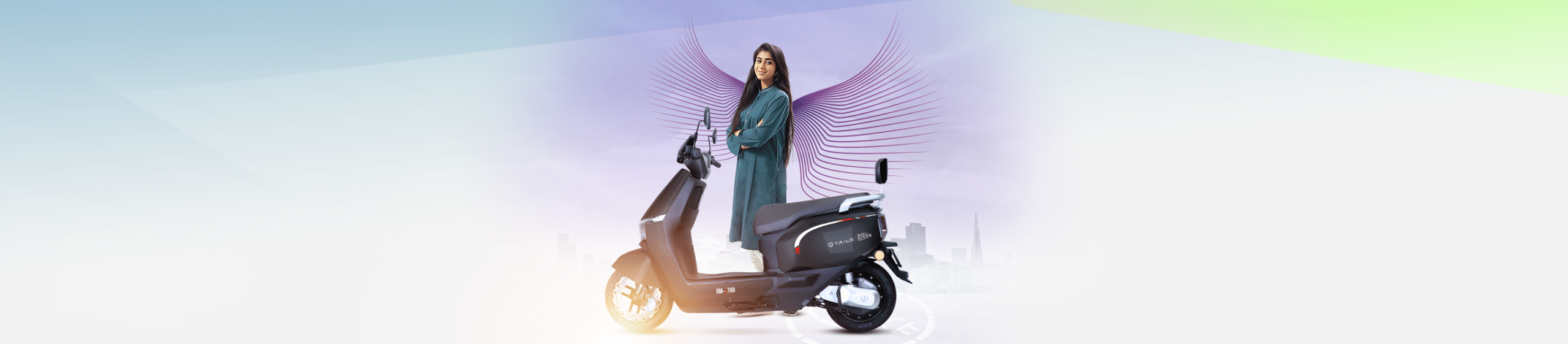

U Bank Scooty Financing

Offering ease and independence for women

U Bank offers an exclusive Scooty Financing facility with loans of up to PKR 350,000 to women for easy commute. Whether you are a female student, entrepreneur, or a working woman, U Bank Scooty Financing brings an opportunity to have access to your bike on flexible and easy installment plans, and Credit Life Insurance. Now enjoy mobility with ease and independence!

Scooty Brands Available: HI Speed

Limited Time Offer Promotion: FREE Helmets for the first 100 customers

Shana Bashana Loan

Empowering Women, Enabling Success!

U Bank is offering women entrepreneurs the perfect opportunity to receive financial services for their business needs. With an aim to empower women through financial inclusion, Shana Bashana is a specialized loan that facilitates them to fulfill their working capital requirements and establish, diversify, or expand their business ventures at low markup rates.